As a UK business you have to register for VAT (value added tax). Stick with me on this. You have to register “if your turnover of VAT taxable goods and services supplied within the UK for the previous 12 months is more than the current registration threshold of £79,000, or you expect it to go over that figure in the next 30 days alone.”

Oh, but “if your turnover has gone over the registration threshold temporarily then you may be able to apply for exception from registration.”

And that’s just for a company that supplies goods or services within the UK.

Let’s strip away the confusing explanations then shall we?

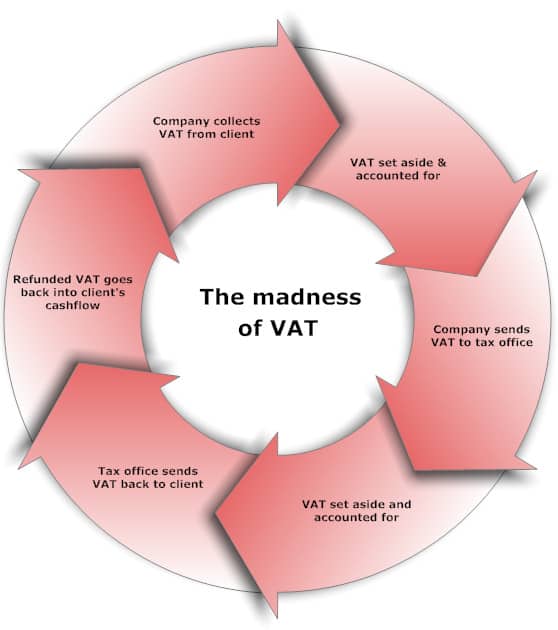

As a UK company I have to charge our UK clients VAT at 20%.

I then have to set aside this 20%, and pass this on to the fine folk at the Tax Office.

The client then reclaims the 20% extra that they paid, from the Government’s Tax Office.

In other words if I charge the client £1,000, they have to pay an additional £200.

I then pay the £200 to the Tax Office, who then pay it back to the client.

And that’s just for a UK business supplying goods or services within the UK. When it comes to handling payments from companies based in the EU, then it really starts to get ridiculous.

Can you see the issue here?

The obvious issue? The mind-popping, jaw-dropping and astonishing issue?

Here’s a hint: it’s almost 2014.

We’ve put people on the moon, built gigantic stations in space, eradicated smallpox, and one day will get rid of cancer. As a species we’re astonishing.

Yet we still can’t work out a system to avoid pointless admin and money changing hands in a circle, between companies who all have uniquely generated and easy to confirm official identities.

If you look inward, at your own company, can you see any processes, systems or structures as absurd and easy to resolve as the madness of VAT?

Click here for more fascinating details of the VAT system.

Unique ideas for your business

The Demystifier puts practical ideas into your hands. You won't find them elsewhere. Original, actionable and insanely effective.